Graduating seniors may breathe an easy sigh of relief knowing that the probable student loan rate hike will not affect them. Underclassmen may wipe their brow knowing they have another year to hope for the job market to right itself. In this economy, no one has it easy upon graduation; and with the

impending tuition raise, staying in school longer has become a less attractive option.

Mitt Romney and President Barack Obama have both hit the campaign trail hard recently in an attempt to attract more college students to their bases. The student population was a huge factor in the 2008 election and may prove to be again in November. These candidates both agree that the 2005 loan rate cut needs to be extended.

And both candidates are right. Failure to extend the loan cut will result in interest rates doubling for student loans on July 1. That will be a major factor in students’ decisions about returning to school and about whether they can afford to come back to school.

The high cost of college tuition represents an investment for the future. We’ve all seen the statistics — statistics that the President cited in a speech at the University of North Carolina on Tuesday — about how much better off college graduates are, how much more they make over the course of their career and how much less likely they are to be unemployed.

But the statistic not cited by the President — and one that Romney is hammering him for — comes from an AP analysis that shows that about half of young college graduates are either unemployed or underemployed in jobs that don’t utilize their skills. In other words, half of college graduates are doing things that they could have been doing for the last four years, without up to hundreds of thousands of dollars in loans (Obama said that the average student borrower graduates with about $25,000 in debt).

This calls into question what a college degree is truly worth. Until the financial crisis shortly before Obama’s election, it seemed a rite of passage for many young Americans that they would attend some sort of college. Loans were thought of as necessary expenditures that would repay themselves many times over in the future.

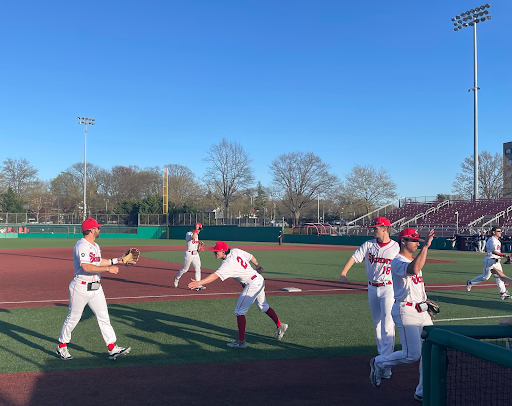

As all of this goes on, tuition prices continue to rise. At St. John’s, tuition is now over $34,000 a year. For rising seniors, that’s about $5,000 more than they paid when they came to St. John’s as freshman in 2009. Has the value of a St. John’s education risen that much? Have the costs associated with running the school increased that much?

There is no way to know whether graduating with a diploma from St. John’s will make our lives better. It will take years to recognize the true value of our degree, years spent repaying loans, and even then there is little we can do to change it.

The true problem is that there is also little we can do the change the issue now. It is undeniably in our best interest to get a degree. As Obama said, “a higher education is the clearest path into the middle class.” So while most of us will shake our heads at rising tuition costs, we’ll do little more than dig deeper into our parents’ savings, or worse, take out more loans.

As long as more people keep applying, St. John’s and other colleges have little incentive to stop hiking their costs. But what they can do is show a little transparency. Show us what our money is actually paying for. Explain why the price keeps rising. And justify why, in the face of all the depressing statistics about college graduates, the benefits of a St. John’s education outweigh the costs.