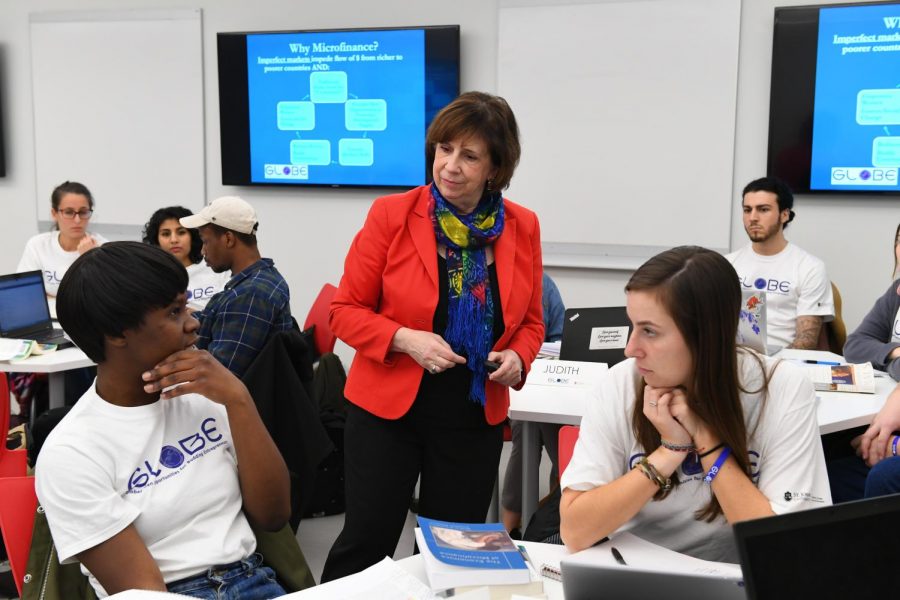

A common critique of university education is that its focus tends to stay within the classroom rather than offering opportunities for hands-on experience. GLOBE (Global Loan Opportunities for Budding Entrepreneurs) is an undergraduate student-managed program here to take the learning outside, branching out to the rest of the world.

In the semester-long class, students get the opportunity to manage a project that provides microloans, small sums of money lent at a low interest rate to a new business, to entrepreneurs living in poverty around the world.

GLOBE students learn about microfinance and social entrepreneurship, and perform hands-on work in task-based teams that brings what they learn and receive in the classroom to life.

The teams are: Finance, Budgets and Risk Assessment; Marketing and Fundraising; Technology and Communications; and Enterprise Development and Program Impact Audits.

The loans are sourced through donations; members of GLOBE are assisted by the Daughters of Charity, whose mission includes identifying those in their communities who want loans to start new small businesses, expand existing ones.

Those seeking funds to either make repairs to infrastructure that houses a business, or to purchase transportation to their place of work are also eligible.

“Borrowers understand that by paying back the money, they are helping their communities and learn about the obligations that come with a loan so that later on, as they go on to a more established microlending institution for a loan, they know what to expect.” Associate Dean for Global Initiatives at Tobin and founder of GLOBE Linda Sama said.

Sama started the program in 2009; her first action was to form a Steering Committee to govern the program that began with three people and grew to a committee of 13.

Members include faculty and administrators from St. John’s, representatives from the Ladies of Charity, a Daughter of Charity, representatives from both for-profit and not-for-profit businesses and GLOBE alumni.

Sama’s role as chair of the GLOBE Steering Committee involves calling meetings when student managers have loans to recommend for committee approval, team objectives to present or new strategies for the program and its operations that require Steering Committee review and approval.

“Our loans carry a small interest fee, which stays with the communities where GLOBE operates. The Daughters may use these fees to buy books for the primary schools, medicines for the sick, or as part of their GLOBE fund to support newly approved loans,” she said.

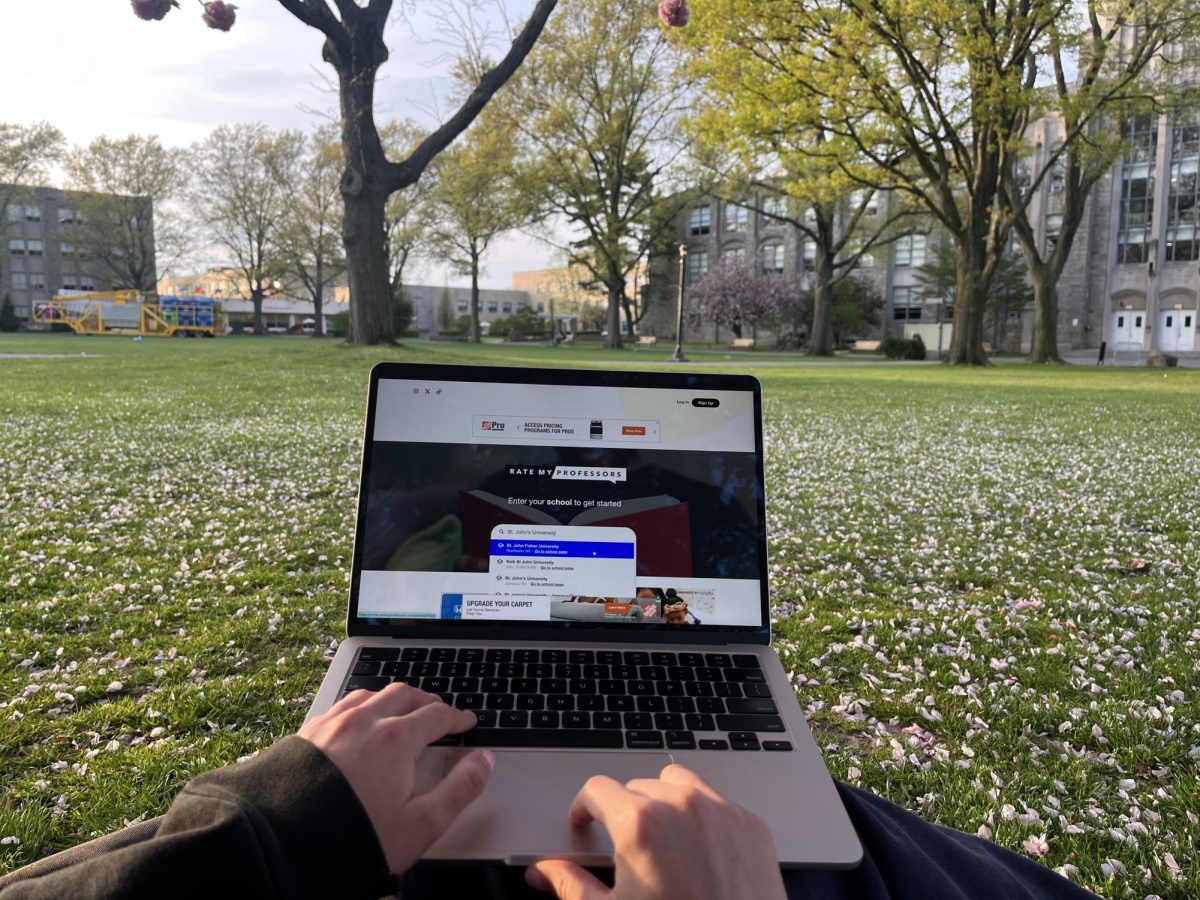

The GLOBE program is open to all students enrolled in Tobin with a GPA of 3.0 or above; St. John’s students enrolled in other colleges can also apply, as long as they meet the GPA requirement, or according to Sama, “can offer some parallel experience that will make them prepared to handle the rigors of the course.”

GLOBE students gain experience in microfinance and social entrepreneurship.

Every student who applies for GLOBE is interviewed, and anywhere from 14 to 24 are chosen for a seat in the class.

“We look for a passion for the GLOBE mission, a commitment to hard work, and the ability to work well in a team,” Sama said.

“GLOBE has taught me the dynamic influence of microfinance in the developing world and in the non-profit field,” Judith Russell, a member of GLOBE’s Communications and Technology team as well as a staff writer for the Torch, said. “Microfinance can be a controversial subject. It has both negative and positive consequences in the sense of its effect on a community.

On one hand, it can be looked down upon socially and it can throw an already struggling person further into debt. On the other hand, we give these struggling person opportunities that were never given to them before.”

GLOBE’s borrowers consist of both men and women — about 85 percent are women, which is a similar statistic to the microfinance industry as a whole.

“Microloans have been demonstrated to be very empowering for women — an important fact to keep in mind this International Women’s History Month,” Sama said.

“And women have demonstrated that they are better borrowers than men statistically, that is they pay back their loans more reliably.”

Sama also teaches the class by providing lectures on various aspects of microfinance and social entrepreneurship, guiding student teamwork, reviewing and assessing learning, inviting guest speakers and facilitating class field trips to events going on in the region relevant to their learning.

In 2010, Sama started the GLOBE Student Fellows Program, where the fellowships are jointly sponsored by GLOBE donors and the Center for Global Business Stewardship at Tobin where she serves as executive director.

Each year, up to four fellows get the opportunity to travel with Sama to someplace in the world where GLOBE operates or to a microfinance conference.

Student members involved in GLOBE and undergraduates enrolled in Tobin are invited to apply for the Fellows program.

Angela So, the Marketing and Fundraising team’s liaison in fall 2017, created, organized and successfully executed fundraising events that featured marketing awareness initiatives.

The team worked with GLOBE’s Information Technology team to have marketing collateral like flyers and videos to be created so that they could advertise for the events.

So explains that when she was a student manager of GLOBE, she learned a lot about microfinance and how it provides opportunities for people who are in conditions of poverty to improve their situations.

“Microfinance relates itself to the famous pithy, where if you give a man a fish, he is fed for a day but if you teach him to fish, he is fed for his lifetime,” So said. “Microfinance allows for microloans to be given to people who have no credit, usually of developing countries, so that they can have a kick start fund to execute their business idea while still providing a sense of responsibility for them to hone in on.”

Russell says that she hopes that the program can create “empathy” and “curiosity within others.”

“I think these are such important, yet underestimated traits to have in the modern world. For the sake of making the world a better place, it is critical we are reminded of our capabilities,” she said.

“There are not many opportunities where a student can manage a business, be enrolled in an accredited class, and also help the poor,” she added.

“That is one of our biggest challenges as a Communications/IT team — it’s difficult to get people to understand, or even care, about the program. In the end, if we garner more support as an organization we could also fundraise more money and give out more loans.”