The college application process is long, tedious and at times, painful. First, you have to find the right match for your academic needs.

Next, you have to fill out applications, get recommendations and print out copies of your transcripts.

But while being accepted may seem like the end of the journey, there is another issue that needs to be settled: how are you going to afford the tuition, especially in a time of economic recession?

The Bureau of Labor Statistics reported that in Dec. 2008, the unemployment rate jumped from 6.8 to 7.2 percent, estimating more than 11.1 million people were currently without jobs.

The problems that go hand in hand with this situation are how people are going to pay for their rent, keep up with medical bills, and even put food on the table.

Now more than ever, tuition and financial aid play a huge part in many people’s decision to attend college, or even stay in school.

State schools and community colleges have a lower cost in tuition, compared to private universities. The difference can range from hundreds to thousands of dollars, depending on the school.

For many students, this plays a big part in choosing a college, and in some cases even staying at a college.

Stony Brook University, a New York state college located on Long Island, costs $15,252.00 to attended as a full time, undergraduate student for in state residents.

University of Albany, another state college located in upstate New York, costs $15,858 including tuition, fees and room and board for undergraduate students taking 12 or more credits, who live in the state.

Somti Ebi, a transfer student from The University of Houston, understands the difference in prices betwee private and public institutions.

“St. John’s is more expensive than my old University, where tuition was under $10,000,” she said.

“Scholarships that I received did nothing to help lower the price of attendance here” .

Private schools tend to have a heavier price tag connected to their services.

St. John’s University is a four- year private university, with tuition for a full time student at $28,000 a year. This does not include room and board (ranging from $6,700 to $9,600), and various fees.

Nina Brenis, a sophomore, transferred from Hunter College, which is a CUNY school, to St. John’s this semester.

“I feel that it is worth the extra money to attend St. John’s” she said. ” It offers a better faculty, professors and overall education.”

In a time where job security is uncertain, students may have to adjust how they finance their education due to an unforeseen turn of events.

While all of these numbers can be overwhelming, there are ways to get a grasp on financing your college education.

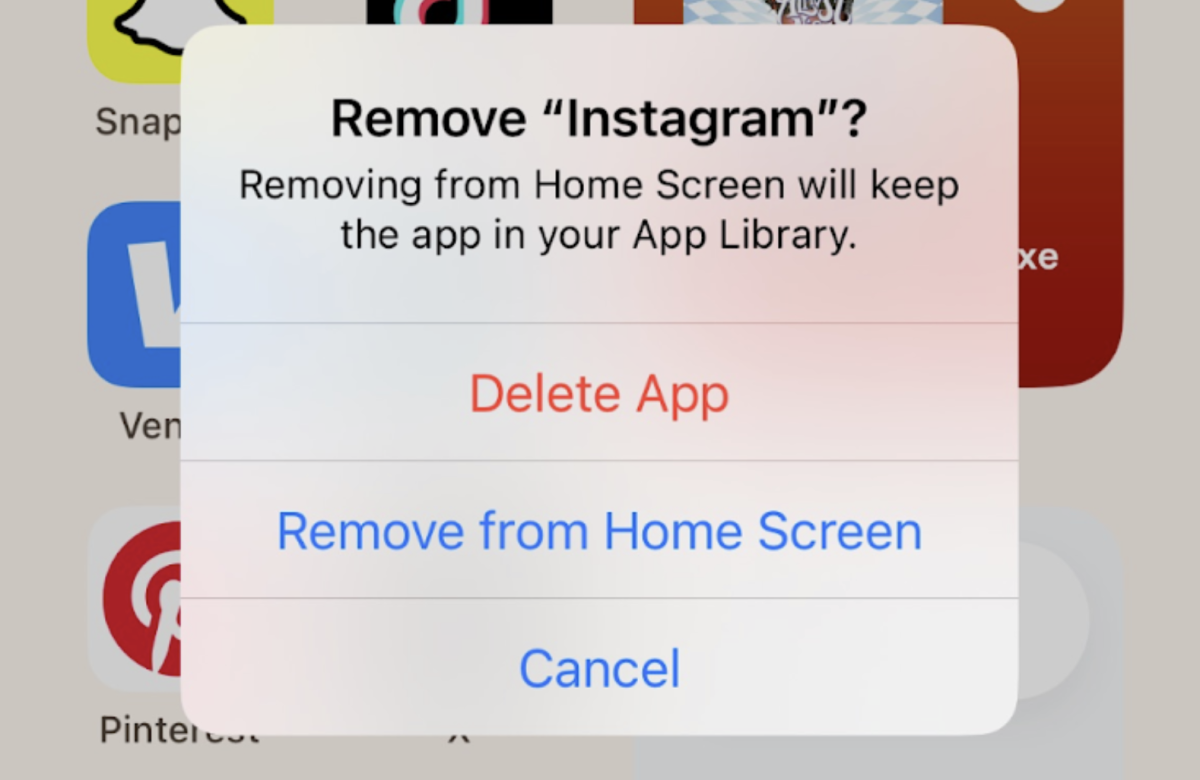

The first step is figuring out how much aid you are eligible for from the government. Start by filling out the Free Application For Student Aid, more commonly known as FAFSA.

The aid is estimated based on your expected family contribution, year in school, enrollment status and the cost of attendance at the school.

Depending on all of the factors listed previously, the amount given by the government may not be enough to cover all of your expenses.

The hunt for loans is similar to the search for colleges: finding the best way to finance in order to fit your needs.

Federal Stafford loans are student loans that carry 6.8 percent interest. The amount that can be borrowed a year can increase annually, starting at $3,500 for the first year.

Another type of loan that is available to certain students is called the Federal Plus Loan. This loan is only available to guardians of dependent undergraduate students.

Paying back loans can be held off for up to three years in certain circumstances, and the loan is forgiven if the parent borrower dies, or suffers a permanent total disability.

Private loans are also available, and allow students to take out larger sums of money.

While it is helpful to be able to take out more money to cover living expenses, there are also some drawbacks.

While other loans come with fixed interest rates, private lenders tend to have interest rates that vary from year to year.

A college education is an invaluable tool that can help propel you into the work force at full speed, and is a necessity in the 21st century, no matter what the price tag is.