Managing your finances as a college student is not an easy task. Many of us are faced with tight cash flows that make it hard to do things like paying our tuition, making our car payments and buying MetroCards. Little things that make our lives better add up, like movie tickets, sporting event tickets or road trips. When facing these problems, it is best to go back to the basics when it comes to planning your finances.

Fortunately, there are three easy ways St. John’s students can improve their finances: saving while on campus, saving while off campus and saving while traveling back and

forth from on campus to off campus.

Saving while on campus is easy, thanks to the dining dollar plans that Chartwells offers students. While you may be reluctant to turn over hard-earned dollars to Chartwells, the discount they provide will have a significant impact on the

price of its goods over the long term.

For example, buying three Venti coffees per week at Starbucks, which cost $2.28 each, including tax. Compounded over the 13 weeks that make up the spring semester, someone would be paying $88.92. Compounded over the course of a whole school year, that’s a toal of $177.84.

Instead, paying with Storm Card dining dollars will have no sales tax and allow a 10 percent discount, which is obtained via the bonus received when adding money to the card.

If a student does this, they will only pay $147.61 a year for coffee, a savings of $30.23. Plus, they won’t have to worry about any overdraft charges or hidden fees on your Storm Card that they would have to watch when charging an item with a debit or credit card.

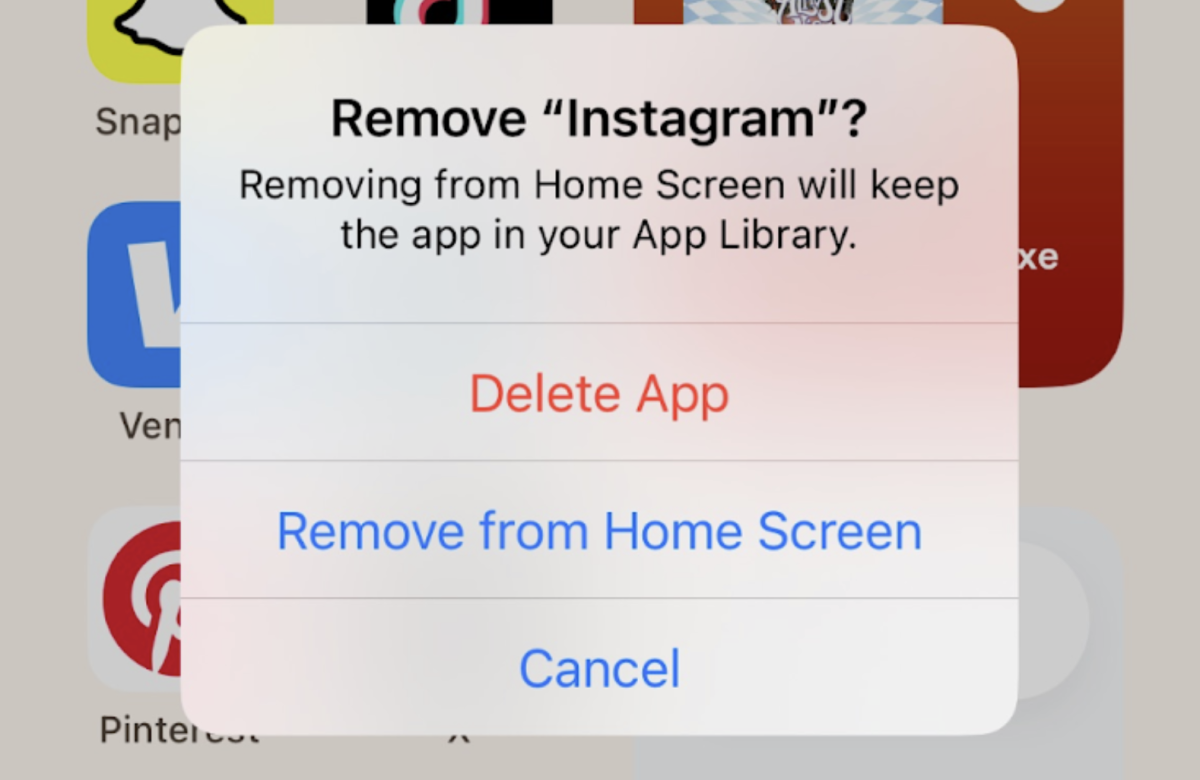

Saving while off campus has many facets and is just as realistic. This includes, most importantly, choosing which bank you have an account with. Finding a bank that has convenient locations can save a lot of money when using an ATM frequently. Being aware of ATMs that advertise no fees or 99 cent fees is key. While an ATM may only charge a 99 cent fee, bank many times will charge a fee in addition to this.

In order to save on transportation to and from campus, resident students need to plan in advance and commuters need to do their research.

Resident students can save loads of money by booking to go home in advance. For example, if you live in Boston, can book a seat on Amtrak for May 11 (the last day of exams) for $49. If you try to book a seat for next Tuesday to Boston, the lowest fare is $64. This has an even bigger difference when you are traveling home during a holiday period like Thanksgiving or Christmas.

Commuter students can save even more money by utilizing the St. John’s shuttle system, which can save students a painful $2.25 subway fare. The St. John’s shuttle runs to Manhattan, Staten Island, the Jamaica Long Island Railroad station and Kew Gardens every day via a motor coach

open to St. John’s students only.

Cutting back on the little things in life can add up, eventually making a big difference. Hopefully, by following these tips, a college student will be able to put a little bit

of cash back in their wallet.